Cryptocurrencies allow you to buy goods and services, earn passive income, or invest with the goal of generating returns on your capital.

In this guide, we will see everything you need to know about investing in cryptocurrencies.: what they are made of and how they are purchased, to the pros and cons of this type of investment.

What are cryptocurrencies

Cryptocurrencies are digital assets that use blockchain technology to secure ownership and can be transferred securely.

The blockchain technology used by cryptocurrencies is similar to old registers where balances and transactions were recorded, but in this case the register is electronic and its data is unalterable.

Some examples of the best known cryptocurrencies are Bitcoin, Ethereum, Binance or Tether. Each cryptocurrency can have different uses depending on its design, such as:

- Unit of exchange of goods and services

- Store of value

- Enable more complex financial transactions through the use of smart contracts

How to start investing in cryptocurrencies

If you want to invest directly in cryptocurrencies, you can use a cryptocurrency exchange. Here is how to invest in cryptocurrencies step by step:

First of all, you need to choose an exchange, create an account and send funds according to the allowed deposit methods. Next, you need to do research to determine which cryptocurrencies you want to buy and submit orders to buy your chosen cryptocurrencies to the exchange. Once purchased, you should keep cryptocurrencies securely, preferably in an off-exchange wallet or e-wallet.

After this brief summary, we will continue to see the process in detail.

How to Buy Cryptocurrencies (Safely)

As we have just seen, to buy cryptocurrencies, you must use an exchange.

Exchanges are the platforms where the buying and selling of digital currencies takes place, in addition to providing other services related to investing in digital assets.

The process of buying cryptocurrencies through an exchange would be as follows:

1. Decide where you want to buy

There are different types of exchanges, but the easiest way for someone just starting out is with a centralized exchange.

Some well-known examples are Binance, Coinbase, Kukoin or Bit2me.

Centralized exchanges, or CEXs, act as intermediaries and ensure that transactions are carried out in a simple and fair way: that the user receives the amount of cryptocurrency that he paid for in exchange for a fee charged by exchange for his services.

Other options would be through a decentralized exchange (DEX) or through a traditional brokerage that offers services for buying and selling cryptocurrencies.

I leave you an article where I explain in more depth the different types of platforms that exist to invest in cryptocurrencies.

>> Learn more: Cryptocurrency trading platforms

If you are just starting out, the best thing to do is to choose a well-known and reputable exchange with a large number of cryptocurrencies. Some examples would be Binance, Coinbase or Bit2me.

2. Open an account and deposit money

You must first provide your personal information and, in most cases, verify your identity to complete the registration process.

Finally, you must transfer funds to the account in the currency of your country, usually euros or dollars. There are many payment methods, such as bank transfer or credit card, so it’s a simple process.

3. Choose the cryptocurrency to invest in

Choosing which cryptocurrency or token to invest in is the most complicated part of all, like when we want to invest in any other financial asset such as stocks. Because it’s more complex, I’ll talk more about it in the following sections.

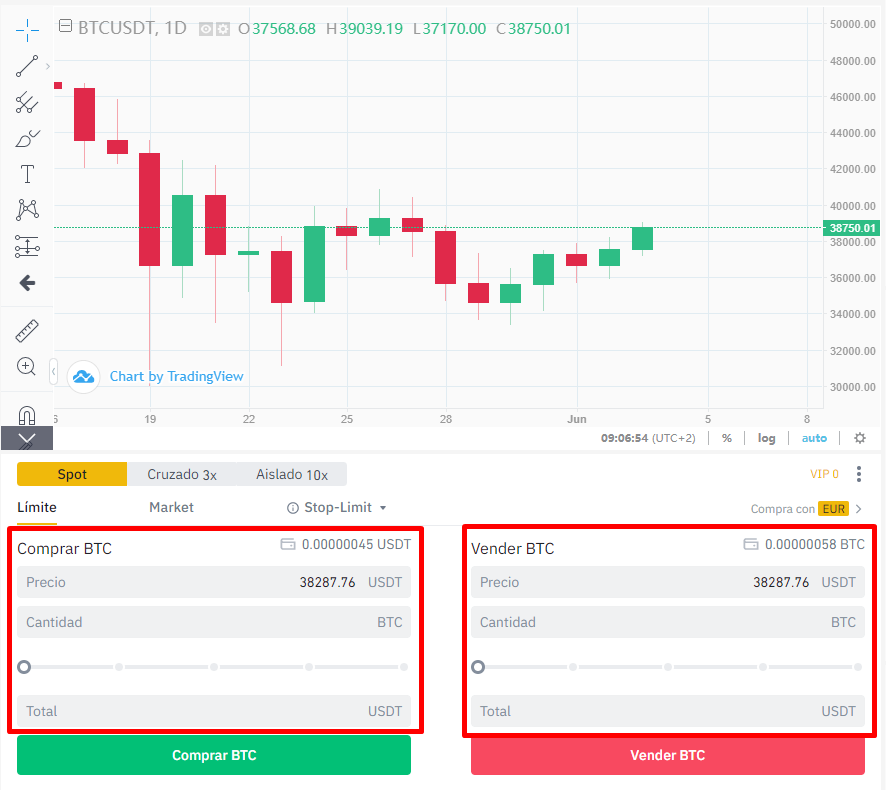

4. Place Purchase Orders

Finally, we will place the buy order for the selected cryptocurrency.

In case you have any doubts about the types of commands and how they are sent, I leave you to the next article where I explain myself. I’m using examples from the Binance exchange, but it would be similar for the rest of the platforms.

>> Learn more: Binance Order Tutorial

What cryptocurrency should I buy?

Perhaps the most important thing when investing in anything is to do your homework and think carefully about where we are going to put our money.

In crypto investing, this is all the more important as it is a new market, whose projects are often in development and are more complex from a technical point of view. Moreover, there are thousands of different cryptocurrencies, so choosing a few is a difficult task.

Our options are to hire an expert cryptocurrency financial advisor or educate ourselves as much as possible and do our own research to determine what we should invest in.

What we should never do is buy a cryptocurrency just because someone tells us or advises us without being a demonstrable expert in the field.

To analyze and choose in which cryptocurrencies to invest, we can use several types of analysis:

- Fundamental analysis of cryptocurrency: it focuses on analyzing the project to determine what it actually does, whether it has the potential to be enjoyed in the future, and whether it is legitimate.

- Technical analysis: involves analyzing graphs and patterns.

- String analysis: allows the analysis of a cryptocurrency through all the activity that happens on the blockchain.

Personally, when investing in cryptocurrencies, I like to perform in-depth fundamental analysis and rely on technical analysis to determine entry levels and generally gauge the phase of the market it is in.

Some articles that may be useful to get you started are:

>> Learn more: Fundamental Cryptocurrency Analysis Guide

>> Learn more: Guide to technical analysis of cryptocurrencies

And to be able to start seeing different projects in a more practical way, I recommend a few free sites:

>> Learn more: What is Coinmarketcap and how to use it?

>> Learn more: Real-time cryptocurrency charts

Store cryptocurrencies securely

Once you’ve decided which cryptocurrencies to invest in and bought them on an exchange, the next decision is how to store them.

This is an important issue because one of the mottos of cryptocurrencies is «be your own bank». So you need to know how to store cryptocurrencies safely and how to send them to other platforms, other people or pay for services with them.

Owners of digital assets use wallets or digital wallets to store their assets, there are different options:

- Storage on third-party platforms: An example is keeping cryptocurrencies on the exchange where you purchased them.

- Use your own wallet: This is basically software where we personally store our cryptocurrencies.

Therefore, the decision you have to make is between storing the digital assets you own yourself or having another company or entity do it for you.

The best option is to store the cryptocurrencies ourselves in a hardware wallet, since they are the most secure.

>> Learn more: Cryptocurrency wallets

What you must know to invest in cryptocurrencies (5 keys)

We will now look at some considerations you should keep in mind before you start investing in cryptocurrencies.

Risks of investing in cryptocurrencies

Investing in cryptocurrencies is considered a risky investment. The prices of cryptocurrencies, even the most established ones in the market, move quickly and fluctuate more than the prices of other investment assets such as property or stocks.

Other types of risks are, for example, future regulatory changes or bans on the use of cryptocurrencies in certain countries.

This is why it is important not to invest more money in cryptocurrencies than you are prepared to lose.

Training and learning

The world of cryptocurrencies is fast and constantly changing, so it is advisable to train constantly.

And not just in everything related to the world of crypto, but it is good to have knowledge about investments and risk management in general.

investment strategy

Along with doing your homework and researching which projects to invest in, you need to have an investment plan.

We need to know where we will enter and how (we will buy in strong corrections, in accumulation phases, we will do DCA…), what will be our plan to make profit or when we will exit the market if our investment goes against us.

And more generally, we need to determine what % of our total investments will occupy digital currencies.

Diversification

One way to manage risk in our cryptocurrency portfolio is to diversify the range of cryptocurrencies in which we invest. Therefore and depending on our risk profile, we can select cryptocurrencies of different capitalizations and in turn from different sectors.

Although all cryptocurrencies generally move in a correlated manner, especially during periods of high volatility, it is clear that their behavior is not the same.

For example, this is not the same way Bitcoin behaves as a cryptocurrency of a metaverse ranked 500 by market capitalization.

Various Ways to Invest in Crypto

When you consider investing in cryptocurrencies, the first thing that comes to mind is to buy one or more cryptocurrencies. But apart from direct purchase, there are other ways to invest in cryptocurrencies.

You can invest in stocks of industry-related companies like Coinbase or companies that have large amounts of cryptocurrency on their balance sheet like MicroStrategy. There is also the possibility of doing this through investment funds or ETFs.

Other avenues to consider are exploring investing in non-fungible tokens (NFTs) or earning passive income through decentralized finance platforms.

If you have little experience, it is better not to complicate your life and invest in a simple way, but over time you will be able to explore other ways of making money with cryptocurrencies.

The pros and cons of investing in cryptocurrencies

Let’s look at some pros and cons of investing in cryptocurrencies:

ADVANTAGE

- Diversification: Cryptocurrencies, being a new financial asset, allow us to diversify our investment portfolio and not only to expose ourselves to traditional assets.

- Potential return: Cryptocurrencies have produced strong returns as their use has become more widespread. For example, bitcoin has been the best performing asset for the past decade and is likely to continue its strong trajectory at some point.

- Utilities: Some cryptocurrencies offer returns while we invest in them. Bitcoin, for example, can be used to pay for goods and services, and other tokens provide access to purchase projects, loans, or cryptocurrencies to earn passive income.

- Understand and discover emerging technology with implications in many sectors.

disadvantage

- Volatility: Cryptocurrencies have very strong and sharp fluctuations.

- Theft, fraud and scam: Unfortunately, this is a sector very exposed to scams, frauds and thefts, so it is an additional risk to take into account.

- learning curve: The learning curve can be somewhat slow as you need to understand the technology and familiarize yourself with the methods of storing and using cryptocurrencies.

The best cryptocurrencies to invest in (where to start)

In February 2022, there were over 17,500 different cryptocurrencies [1]. Additionally, there are millions of different NFTs that are based on similar technologies and allow ownership of images and digital assets.

Under these conditions, determining which are the best cryptocurrencies in which to invest is something very relative.

First, there is no telling what the future performance of the crypto market or its sectors will be. Second, it is necessary to examine each project individually to try to determine its potential.

And finally, the best cryptocurrencies will depend on their investor profile: someone who wants to buy bitcoin with a long-term view is not the same as another person who wants to invest in small tokens. capitalization in search of high returns. Therefore, we must be clear about our objective as investors and do our own research.

However, here are some ideas to get you started.

If you are just starting to invest in cryptocurrencies, you can focus on the biggest and strongest projects. Read the document, understand how it works, and determine its potential use.

These are the 10 largest cryptocurrencies by market capitalization according to Coinmarketcap (February 2022):

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- BNB (BNB)

- Currency USD (USDC)

- XRP (XRP)

- Gimbal (ADA)

- Sun Sun)

- Earth (MOON)

- Avalanche (AVAX)

With time and more experience, you can do dissertations on the crypto market and try to figure out which sectors will boom the most, research the cryptocurrencies with the greatest future, and make a selection based on this one.

Other options are to focus on sectors where you have more knowledge or want to specialize, such as metaverse cryptocurrencies, Play to Earn games, or DeFi cryptocurrencies.

Or simply look for cheap cryptocurrencies, i.e. those with very good fundamentals, but still a small capitalization.

These are a few ideas that range from conservative investing to riskier options.

The Legality of Cryptocurrencies and Taxes

Although some countries like China have banned its use [2]investing in cryptocurrencies in most countries of the world is legal [3].

Regardless of the above, when you invest in cryptocurrencies, you have to pay taxes on the profits you make. In other words, when our cryptocurrencies are sold, we have to pay taxes on the difference between the purchase or sale price. There are also fees if you are stacking or mining.

As this is a question that depends on the regulations of each country, it is best to consult the legislation of the place where you live.

>> Learn more: How to declare cryptocurrency income in Spain

frequently asked Questions

KEY POINTS OF THE ARTICLE

- Cryptocurrencies are digital assets whose operation is based on blockchain technology.

- There are different ways to invest in cryptocurrencies, from buying cryptocurrencies directly to investing in NFTs or mining cryptocurrencies.

- You can buy cryptocurrencies in different ways, but initially it is best to do it through a centralized exchange.

- Investing in cryptocurrencies involves risk because it is a volatile asset and for other reasons arising from the fact that it is a brand new asset.

ARTICLE SOURCES